Executive Summary

The contemporary financial technology landscape is characterized by a profound dichotomy. On one side stands the legacy banking infrastructure—a domain governed by rigid regulatory frameworks, centralized databases, and decades-old transaction protocols such as ACH and SWIFT. This infrastructure ensures stability and compliance but often at the cost of agility and interoperability. On the other side lies the burgeoning decentralized finance (DeFi) sector, driven by blockchain technology, which offers atomic settlement, programmable money, and borderless liquidity, yet frequently lacks the user experience and regulatory guardrails required for mass adoption.

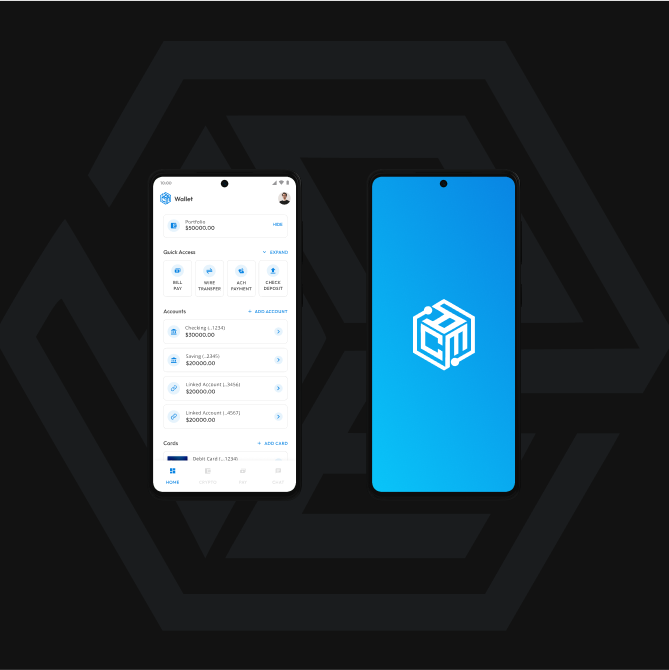

For enterprise-grade applications, the challenge is no longer merely to choose between these divergent worlds but to engineer a cohesive system that orchestrates them seamlessly. This report documents the architectural engineering of Wallet, a proprietary fintech framework developed in-house by Acme Software. Wallet was conceived not as a mere application, but as a comprehensive solution to the “Integration Gap”—the immense technical debt, latency, and security risk incurred when attempting to unify disparate financial providers into a single, fluid user experience.

Wallet leverages a high-performance technology stack comprising Flutter for cross-platform ubiquity, Golang for high-concurrency orchestration, and MongoDB for flexible, ACID-compliant ledger management.1 This architecture establishes a new standard for white-label fintech solutions, capable of bridging the fiat-crypto divide while maintaining the rigorous security standards expected by institutional partners.

This document serves as an exhaustive technical remediation report, detailing the engineering decisions, trade-offs, and scalability patterns that define the Wallet ecosystem. It is intended for senior engineering stakeholders, investment boards, and prospective enterprise partners evaluating the reliability of integrating a hybrid fiat-crypto architecture.

1. The Architectural Imperative: Solving the Integration Gap

The core problem facing modern fintech development is not a scarcity of capability, but an overabundance of disconnected micro-services. A typical neobank requires a constellation of third-party integrations: an identity provider (Auth0) for security, a KYC verifier (Sumsub) for compliance, a banking-as-a-service provider (Unit) for accounts, a payment processor (Stripe) for ingress/egress, and a blockchain gateway (Tatum) for digital assets. Orchestrating these services requires a “super-application” architecture that can maintain state consistency across asynchronous, distributed systems without exposing the user to the underlying complexity.

1.1 The Legacy Monolith vs. The Modular Ecosystem

Historically, banking applications were constructed as monoliths. In these legacy systems, the ledger, the user interface, the payment gateway, and the compliance rules were tightly coupled within a single codebase, often running on mainframes. While stable, these architectures are fundamentally incompatible with the modern API economy. They cannot easily integrate with external services, adapt to new blockchain protocols, or scale specific components independently.

Wallet adopts a modular microservices strategy, where the backend acts as an intelligent orchestration layer rather than a simple database interface. The design philosophy prioritizes Eventual Consistency for distributed transactions (via the Saga pattern) while strictly maintaining Strong Consistency for the internal ledger. This hybrid approach ensures that while external confirmations—such as a blockchain block confirmation or an ACH settlement—may face inherent latency, the user’s internal view of their balance remains mathematically accurate, responsive, and protected against double-spending vectors.

1.2 The “Super-App” Dilemma

The ambition to build a “Super-App”—one that handles everything from stock trading to crypto swaps to peer-to-peer payments—often leads to “bloatware,” where the mobile application becomes heavy, slow, and difficult to maintain. Wallet addresses this by offloading the complexity of orchestration to the backend. The mobile client remains a lightweight “view” of the state, while the heavy lifting of communicating with Unit, Stripe, and Tatum is handled by the high-performance Golang server. This separation of concerns is critical for maintaining the “60 frames per second” performance benchmark that defines premium mobile experiences.

2. Frontend Engineering: Flutter at Enterprise Scale

The selection of Flutter (Dart) for the frontend architecture of Wallet was a strategic engineering decision driven by the necessity for a “write-once, deploy-anywhere” capability that does not compromise on native-tier performance. In the highly competitive fintech sector, user trust is visually correlated with UI responsiveness; “jank,” frame drops, or input latency during a transaction animation can subtly erode user confidence and perceived security.

2.1 The Impeller Rendering Engine: Eliminating Shader Jank

One of the most significant technical challenges in cross-platform development has historically been “shader compilation jank.” This phenomenon occurs when the graphics API compiles shaders at runtime (Just-In-Time or JIT) during the first execution of an animation. In a financial application, this might manifest as a stutter when a user opens a complex spending graph or transitions between the fiat and crypto dashboards.

Wallet leverages Flutter’s new Impeller rendering engine, which replaces the legacy Skia backend on iOS and is being progressively rolled out for Android. Impeller solves the jank problem by precompiling a smaller, simpler set of shaders at engine-build time (Ahead-Of-Time or AOT) rather than at runtime. This ensures predictable performance, adhering to the “16ms per frame” rule required for 60fps rendering, regardless of the animation complexity or the device’s thermal state.

In the context of Wallet’s financial charting—where users visualize asset volatility in real-time—Impeller allows for complex vector graphics, gradients, and gaussian blurs to be rendered without the “first-run” stutter associated with Skia’s shader generation. This technical nuance positions Acme Software as a leader in high-fidelity mobile engineering, utilizing the latest advancements in the Flutter ecosystem to deliver an experience that rivals or exceeds native Swift/Kotlin applications.

2.2 State Management: The BLoC Pattern

Managing the state of a financial application is fundamentally different from managing the state of a social media or content-consumption app. In fintech, state must be deterministic and audit-friendly. If a user initiates a transfer, the UI must immediately reflect a “Processing” state, lock the funds locally to prevent double-spending, and only transition to “Success” or “Failure” based on an authoritative, signed response from the backend.

Wallet utilizes the Business Logic Component (BLoC) pattern. BLoC separates the presentation layer (UI) from the business logic using reactive streams. Events (e.g., TransferRequested) are fed into the BLoC, and States (e.g., TransferLoading, TransferSuccess) are emitted back to the UI.

Why BLoC for Fintech?

- Auditability: Every state change in the application is triggered by a distinct, logged event. This creates a traceable history of user actions, which is essential for debugging financial discrepancies or investigating user reports of failed transactions.

- **Testability: ** Because the business logic is completely decoupled from the widget tree, unit tests can simulate every possible financial scenario—insufficient funds, API timeout, network failure, fraud rejection—without ever spinning up an emulator or rendering a pixel. This allows for high code coverage in the critical financial paths.

- Concurrency Safety: BLoC handles asynchronous streams efficiently. Using RxDart operators like debounceTime or switchMap, the application can automatically handle rapid-fire inputs (e.g., a user nervously tapping the “Pay” button multiple times). The BLoC can be programmed to ignore subsequent taps until the first transaction completes or fails, enforcing a frontend-level idempotency.

2.3 The White-Labeling Engine: Modular Theming

One of Wallet’s primary business goals is to serve as a white-label solution for enterprise partners—allowing a regional bank or a crypto startup to launch a branded wallet using Acme’s infrastructure. This requires an architecture where the brand identity (colors, typography, iconography, and feature sets) can be swapped entirely without altering the core codebase.

Wallet employs Flutter Flavors (Build Variants) combined with a runtime configuration engine.

- Build-Time Configuration: Using Android Product Flavors and iOS Schemes, the build process injects different API keys, app icons, splash screens, and package names. This allows Acme Software to generate distinct APK/IPA artifacts for “Bank A App” and “Crypto Exchange B App” from a single shared Git repository.

- Runtime Theming: A proprietary ThemeRepository fetches JSON configurations from the backend upon initialization. This allows for dynamic “dark mode” toggles, seasonal branding updates, or remote feature toggling without requiring a full App Store update/release cycle.

The “White-Label” architecture extends beyond visuals. It allows for modular feature inclusion. A client using only the Fiat Banking module will not have the Crypto SDKs initialized, saving binary size and memory usage.

3. Backend Engineering: Golang and High-Concurrency

Orchestration

The “Orchestration Layer” is the heart of the Wallet ecosystem. Built with Golang, it serves as the traffic controller between the mobile clients and the constellation of third-party financial APIs. Golang was selected over Node.js or Python due to its superior handling of concurrency via goroutines and channels, its static typing which reduces runtime errors, and its compilation to a single binary for easy deployment.

3.1 The Gin Framework: High Throughput, Low Latency

Wallet utilizes the Gin web framework. Gin is a high-performance HTTP web framework that utilizes a custom version of httprouter. It is designed for speed, boasting performance benchmarks up to 40 times faster than other Go frameworks like Martini.

Key Engineering Decisions:

- Radix Tree Routing: Gin’s routing algorithm uses a Radix tree (compact prefix tree), which ensures that route lookup time is constant regardless of the number of routes defined. For an API gateway handling thousands of endpoints for complex banking and crypto operations, this O(1) complexity prevents latency degradation as the application grows.

- Middleware Chaining: Wallet implements a rigorous chain of middleware for every request. This includes CorrelationID injection for distributed tracing, Idempotency checks to prevent double-charging, Auth0 token validation, and structured logging. Gin’s lightweight context (gin.Context) allows these middleware layers to pass data efficiently down the chain without heavy memory allocation.

3.2 Concurrency Model: Goroutines and Channels

Financial applications often require parallel processing. For example, when a user loads their dashboard, the backend must fetch the fiat balance from Unit, the crypto balance from Tatum, and the transaction history from MongoDB simultaneously.

In a traditional thread-based language (like Java), spawning threads for every request can lead to memory exhaustion (C10k problem). In Node.js, the single-threaded event loop can be blocked by CPU-intensive crypto-signing tasks. Golang’s goroutines are lightweight threads managed by the Go runtime, requiring only a few kilobytes of stack space. Wallet can spawn thousands of concurrent goroutines to handle incoming requests or background tasks without stressing the server.

Channels are used to synchronize these goroutines safely. Instead of using mutexes (locks) which can lead to deadlocks and race conditions, Wallet follows the Go proverb: “Do not communicate by sharing memory; instead, share memory by communicating.” Results from the parallel API calls are passed back to the main handler via channels, ensuring that the response is constructed only when all data is available, or handled gracefully if one service times out.

3.3 Idempotency: The Shield Against Duplicate Transactions

In a distributed financial system, network failures are inevitable. If a client sends a request to “Send $100” and the network connection drops before the acknowledgment is received, the client may retry the request. Without idempotency, this could result in a $200 transfer—a critical failure in banking.

Wallet implements a strict Idempotency Key mechanism to guarantee exactly-once processing.

- Key Generation: The Flutter client generates a unique UUID v4 for every financial transaction request and sends it in the Idempotency-Key header.

- Middleware Interception: The Golang middleware intercepts the request and checks a Redis store for this key.

- Key Found (Completed): If the key exists and the operation is marked as completed, the backend returns the stored response immediately without re-executing the logic.

- Key Found (Processing): If the key exists but is marked as processing, it returns a 409 Conflict or a “Processing” status, telling the client to wait.

- Key New: If the key is new, the backend proceeds. It first sets a “Processing” lock in Redis using SETNX (Set if Not Exists) to atomically reserve the key.

- Atomicity: The backend ensures that the creation of the idempotency record and the initiation of the transaction happen within a controlled scope. If the transaction fails, the key is updated with the failure state, allowing the user to retry if appropriate.

4. Data Layer: MongoDB and Financial Schema Design

The choice of database is critical for a ledger. While relational databases (PostgreSQL/MySQL) are traditional choices for banking due to their strict ACID compliance, Wallet leverages MongoDB. This choice is often debated in fintech; however, modern MongoDB (v4.0+) offers multi-document ACID transactions, which, combined with the flexibility of the document model, provides a distinct advantage for handling heterogeneous financial data (e.g., rigid bank transfers vs. variable-structure smart contract events).

4.1 ACID Compliance in a NoSQL Environment

The myth that MongoDB cannot handle financial transactions is outdated. Wallet utilizes MongoDB’s multi-document ACID transactions to ensure data integrity across the distributed ledger. When a transfer occurs between two users within the Wallet ecosystem (an “off-chain” or “on-us” transfer), the following steps occur atomically:

- A transaction session is started.

- User A’s balance document is decremented.

- User B’s balance document is incremented.

- A distinct Transaction document is created in the log.

- The session is committed.

If any step fails (e.g., User A has insufficient funds, or User B’s account is frozen), the entire operation rolls back. This ensures that money is never created or destroyed due to a partial write, providing the data safety of a SQL system while maintaining the horizontal scalability of a NoSQL architecture.

4.2 The Double-Entry Ledger Schema

Wallet implements a double-entry bookkeeping system within MongoDB. Rather than simply storing a “Current Balance” field that gets overwritten, the balance is a computed aggregation of an immutable ledger of credits and debits.

Schema Structure:

| Collection | Description | Key Fields |

|---|---|---|

| Transactions | Stores the immutable events. | _id, source_account_id, dest_account_id, amount, currency, timestamp, metadata, status |

| Accounts | Stores the current state (cache). | _id, user_id, balance, currency, last_transaction_id |

| LedgerEntries | Individual debit/credit lines. | transaction_id, account_id, direction (DR/CR), amount_snapshot |

This “Event Sourcing” approach allows for perfect auditability. If a discrepancy arises, the system can replay the entire history of transactions to reconstruct the state of any account at any point in time. The Accounts collection acts merely as a high-performance snapshot for quick reads, but the Transactions collection is the source of truth.

4.3 Handling High-Volume Writes

In a high-frequency trading or payment scenario, locking a single document for every transaction can create a bottleneck. MongoDB’s architecture allows Wallet to shard the Transactions collection based on time or account ID, distributing the write load across multiple nodes. This ensures that a surge in activity (e.g., a “Black Friday” shopping event) does not degrade the performance of the ledger.

5. Distributed Transactions: The Saga Pattern

The complexity of Wallet peaks when transactions leave the internal system. A transfer from a Unit bank account to a Tatum crypto wallet involves two distinct external authorities. You cannot “lock” a Unit database row and a Blockchain block simultaneously in a single ACID transaction. To solve this, Wallet implements the Saga Pattern.

5.1 Orchestration over Choreography

There are two ways to implement Sagas: Choreography (events trigger services) and Orchestration (a central controller). Wallet employs an Orchestration-based Saga pattern. The Golang backend acts as the Orchestrator (State Machine). It explicitly directs the flow of the transaction. This is preferred over Choreography for fintech because it provides a clear, centralized view of the transaction state, making it easier to debug and audit.

5.2 The Transaction Workflow

Consider a “Fiat-to-Crypto” purchase. The Saga Orchestrator manages the following steps:

- Step 1 (Local): Create a Pending transaction record in MongoDB.

- Step 2 (External - Unit): Initiate an ACH pull via the Unit API to debit the user’s bank account.

- Success: The Orchestrator advances to Step 3.

- Failure: The Orchestrator triggers a “Cancel” action on the local record and notifies the user.

- Step 3 (External - Tatum): Initiate the Crypto purchase/transfer via the Tatum API.

- Success: The Orchestrator updates the local record to Complete.

- Failure: This is the critical failure mode. The user has been debited (Step 2), but the crypto purchase failed (Step 3). The Orchestrator must now execute a Compensating Transaction.

5.3 Compensation Logic: The “Undo” Button

Since an ACH transfer cannot be simply “undone” like a database rollback, the compensation logic triggers a distinct “Refund” transaction. The Orchestrator calls the Unit API to initiate a credit back to the user’s account for the original amount.

The Golang implementation uses persistent state machines (often backed by a library or a rigorous custom implementation using channels) to manage these asynchronous states. If the server crashes while waiting for Tatum, it reboots, reads the “Step 3 Pending” state from the database, and checks the status of the Tatum transaction to decide whether to roll forward or roll back. This guarantees Eventual Consistency-—the system will eventually reach a valid state (either Money + Crypto, or Money Refunded), but never an invalid one (Money Lost, No Crypto).

6. The “Circle of Trust”: The Unified Integration Layer

Wallet acts as a unified abstraction layer, hiding the immense complexity of the underlying providers from the user. This integration strategy is designed around the “Circle of Trust,” where specific providers handle specific domains of risk and compliance, orchestrated by Acme’s backend.

6.1 Identity and Access Management (Auth0)

Security begins with identity. Wallet integrates AuthO for enterprise-grade authentication. This offloads the heavy lifting of password hashing, Multi-Factor Authentication (MFA), and session management to a dedicated specialist.

- Token Exchange: The Flutter app authenticates with Auth0 and receives a JWT (JSON Web Token). This token is passed to the Golang backend on every API call. The backend verifies the signature against Auth0’s public keys (JWKS) to ensure the request is legitimate.

- Role-Based Access Control (RBAC): Claims embedded within the JWT determine the user’s permissions. A compliance officer logging into the admin panel has different claims than a standard retail user. This logic is handled at the API gateway level, rejecting unauthorized requests before they reach the business logic.

6.2 Know Your Customer (Sumsub)

Regulatory compliance is non-negotiable in fintech. Wallet integrates Sumsub for automated identity verification (KYC) and anti-money laundering (AML) screening.

- Mobile SDK Integration: The Flutter app embeds the Sumsub Mobile SDK. This allows users to capture photos of their ID documents and perform liveness checks (facial biometrics) directly within the native UI, rather than being redirected to a mobile web browser. This integration is crucial for reducing drop-off rates during onboarding.

- Reusable KYC: A key innovation in the Sumsub integration is “Reusable KYC.” If a user has already verified their identity with another service in the Sumsub network, and they consent to share that data, Wallet can verify them instantly without requiring a new document scan. This reduces onboarding time from minutes to seconds.

- Webhook Orchestration: When Sumsub completes a check, it fires a secure webhook to the Golang backend. The backend updates the user’s compliance_level in MongoDB. Only users with compliance_level: “verified” are permitted to execute financial transactions

6.3 Banking and Payments (Unit & Stripe)

Wallet uses a dual-provider strategy for fiat rails to maximize coverage and reliability.

- Unit (Banking-as-a-Service): Unit is used for core banking features—issuing dedicated IBANs/Account Numbers and virtual debit cards.

- Plaid Integration: To fund their Unit accounts, users link external bank accounts via Plaid. Wallet uses the secure “Link Token” flow. The Flutter app receives a public token from Plaid, exchanges it for a permanent access_token and processor_token on the backend, and sends the processor_token to Unit. This ensures that Wallet never sees or stores the user’s bank login credentials.

- Stripe (Payments): Stripe is utilized for card payment processing and instant payouts (Push-to-Card).

- PCI Compliance: The integration handles PCI-DSS compliance by using Stripe’s SDK to tokenize card data on the client side. The raw PAN (Primary Account Number) never touches Wallet’s backend servers, significantly reducing the security auditing scope.

6.4 The Crypto Bridge (Tatum)

Building a crypto wallet usually requires running and maintaining full nodes (Geth, Bitcoin Core) for every supported blockchain—an expensive and maintenance-heavy endeavor. Wallet utilizes Tatum as an infrastructure abstraction layer.

- Unified API: Tatum provides a standardized REST API for over 40 blockchains. Wallet’s Golang backend makes a simple call to Tatum to check a Bitcoin balance, fetch Ethereum transaction history, or broadcast a Solana transfer. This abstracts away the differences in RPC calls and node management.

- Gas Fee Estimation: Tatum provides real-time endpoints to estimate gas fees. Wallet queries this before a user confirms a transaction, ensuring the fee is displayed transparently and preventing “out of gas” errors.

- KMS (Key Management System): For custodial implementations (where the enterprise manages the keys), Wallet integrates with Tatum KMS. This service securely signs transactions locally or in a secure enclave without ever exposing the private keys to the internet

7. Feature Spotlight: AI-Powered Support with Dialogflow

To reduce operational overhead and enhance the user experience, Wallet integrates Google Dialogflow CX. This provides an intelligent, Natural Language Processing (NLP) interface for customer support and transaction assistance.

7.1 Conversational Banking

The integration allows users to query their finances using natural language (e.g., “How much did I spend on coffee last month?” or “Why was my transaction rejected?”).

- Intent Detection: Dialogflow analyzes the user input to determine the intent (e.g., GetTransactionHistory or ReportFraud).

- Fulfillment Webhooks: The detected intent triggers a webhook to the Golang backend. The backend interprets the parameters (e.g., category: “coffee”, date-range: “last month”), queries the MongoDB ledger (utilizing the rich metadata stored in the documents), and returns the calculated result to Dialogflow.

- Response Generation: Dialogflow constructs a conversational response (“You spent $45.50 on coffee in October”) and sends it back to the Flutter chat interface.

7.2 Security and Privacy Redaction

Financial support chats often contain sensitive data.

- Redaction: Dialogflow CX’s security settings are configured to automatically redact sensitive information (PII) like credit card numbers, social security numbers, or passwords from the conversation logs. This ensures that the training data for the AI model does not become a data leak vector.

- Compliance: The integration is fully PCI-DSS compliant, ensuring that the AI layer adheres to the same security standards as the core banking layer.

8. Business & Technical Outcomes

The architectural decisions behind Wallet have yielded measurable benefits for Acme Software and its partners, validating the investment in proprietary IP.

8.1 Scalability and Performance Metrics

- Throughput: The Golang/Gin backend, optimized with connection pooling and goroutines, handles upwards of 10,000 concurrent requests per second on a standard microservices cluster. This scalability ensures that the platform can handle viral growth or market spikes without downtime.

- Latency: The Impeller engine on Flutter has reduced UI render times to consistently below 16ms, eliminating jank even during complex charting animations. This level of polish is critical for retaining high-net-worth users who expect a premium experience.

- Global Availability: By abstracting blockchain nodes via Tatum and banking infrastructure via Unit, Wallet achieves global functional reach without the massive overhead of maintaining physical data centers in every jurisdiction.

8.2 The White-Label Advantage

The modular architecture allows Acme Software to deliver a “Bank-in-a-Box” solution. A partner can request a custom fintech app, and by configuring the Flutter Flavors and theming engine, the team can deliver a production-ready MVP in weeks rather than months. This rapid time-to-market is a significant competitive advantage in the saturated fintech space, allowing partners to capture market share while competitors are still in development.

Conclusion and Roadmap

Wallet represents the maturation of fintech architecture. It moves beyond the fragile scripts of early crypto apps and the rigid monoliths of legacy banking to create a resilient, scalable ecosystem. By combining the type-safety and concurrency of Golang, the expressive performance of Flutter, and the transactional integrity of MongoDB, Acme Software has engineered a platform capable of bridging the fiat-crypto divide.

Future Roadmap:

- Layer 2 Integration: Expanding the Tatum integration to support Lightning Network and Polygon for near-zero cost micro-transactions.

- Biometric Cryptography: Implementing Passkeys (FIDO2) for passwordless authentication flows, further enhancing security and usability.

- AI Financial Advisory: Deepening the Dialogflow integration to offer predictive budgeting and automated savings advice based on user spending habits.

Acme Software invites forward-thinking enterprises to partner in deploying the next generation of financial infrastructure. The technology is no longer a barrier; it is the catalyst.